策略简介 利用Fama三因子模型构建的A股周度百股策略。

环境与数据准备 1 2 3 4 5 6 7 8 9 import numpy as npfrom tqdm import tqdmimport pandas as pdimport osimport gcimport warningswarnings.filterwarnings('ignore' ) from quantools import backtest

1 2 3 4 5 6 7 8 9 10 11 stk_data = pd.read_csv("../data/stk_data.csv" ) stk_data['close_date' ] = pd.to_datetime(stk_data['close_date' ]) stk_data['open_date' ] = pd.to_datetime(stk_data['open_date' ]) open_days_data = pd.read_csv("../data/open_days_data.csv" ) open_days_data['date' ] = pd.to_datetime(open_days_data['date' ]) equity = pd.read_csv("../data/eqy_belongto_parcomsh.csv" ) equity['rpt_date' ] = pd.to_datetime(equity['rpt_date' ]) os.mkdir("../cal_data" )

1 2 3 4 5 6 7 8 9 10 11 print (stk_data.shape)stk_data.head()

TOTAL_SHARES

CLOSE

OPEN

stock_code

open_date

close_date

uadj_close

0

1.945822e+09

160.348451

153.344151

000001.SZ

2006-01-04

2006-01-06

6.41

1

1.945822e+09

155.345379

160.098298

000001.SZ

2006-01-09

2006-01-13

6.21

2

1.945822e+09

155.845687

154.594919

000001.SZ

2006-01-16

2006-01-20

6.23

3

1.945822e+09

158.847530

155.845687

000001.SZ

2006-01-23

2006-01-25

6.35

4

1.945822e+09

155.345379

158.847530

000001.SZ

2006-02-06

2006-02-10

6.21

1 2 3 4 5 6 print (equity.shape)equity.head()

stock_code

EQY_BELONGTO_PARCOMSH

rpt_date

0

000001.SZ

5.014966e+09

2005-09-30

1

000002.SZ

6.738774e+09

2005-09-30

2

000004.SZ

8.952654e+07

2005-09-30

3

000005.SZ

8.290555e+08

2005-09-30

4

000006.SZ

1.007023e+09

2005-09-30

1 2 3 4 5 6 7 8 9 10 11 print (open_days_data.shape)open_days_data.head()

stock_code

HIGH

OPEN

LOW

CLOSE

VOLUME

date

0

000001.SZ

158.347222

153.344151

153.093997

157.096455

15445068.0

2006-01-04

1

000002.SZ

206.631220

194.684662

194.684662

206.188755

38931043.0

2006-01-04

2

000004.SZ

13.191923

13.035620

12.941839

13.098141

401500.0

2006-01-04

3

000005.SZ

9.436105

9.155268

9.042934

9.379937

3713641.0

2006-01-04

4

000006.SZ

18.698245

18.698245

18.698245

18.698245

0.0

2006-01-04

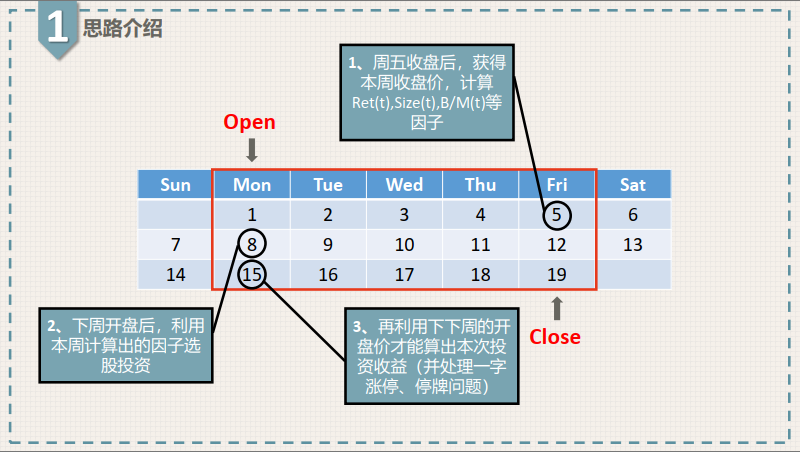

数据计算 计算三因子 在这一步,考虑到公司财报的报告期各不相同,因此采用每批次财报的截止日期作为数据更新日期,也就是说计算账面市值比等因子时,计算因子的日期与财报日期的对应关系如下:

因子日期

报告期

5、6、7、8月

一季报(最晚04.30公布)

9、10月

半年报(最晚08.30公布)

11、12月

三季报(最晚10.30公布)

1、2、3、4月

去年三季报(最晚去年10.30公布)

其中,由于年报与一季报截止时间一致,而一季报比去年年报数据更新,因此我们不使用年报数据。

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 stk_data['mkt_cap' ] = stk_data['TOTAL_SHARES' ] * stk_data['uadj_close' ] def match_rpt_date (date ): """ 将日期转化为对应的报告期; 基于:一季报最晚4/30公布,半年报8/30,三季报10/30,年报来年4/30(因此不用) """ y = date.year m = date.month if m in (5 , 6 , 7 , 8 ): return f"{y} 0331" elif m in (9 , 10 ): return f"{y} 0630" elif m in (11 , 12 ): return f"{y} 0930" elif m in (1 , 2 , 3 , 4 ): return f"{y-1 } 0930" stk_data['rpt_date' ] = pd.to_datetime(stk_data['close_date' ].apply(lambda x: match_rpt_date(x)))

1 all_data = pd.merge(stk_data, equity, on=['stock_code' , 'rpt_date' ], how='left' )

1 2 3 odd = {} for key in tqdm(['HIGH' , 'OPEN' , 'LOW' , 'CLOSE' , 'VOLUME' ]): odd[key] = pd.pivot(open_days_data, index='date' , columns='stock_code' , values=key)

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 odd['pred_rtn' ] = (odd['OPEN' ].shift(-2 )-odd['OPEN' ].shift(-1 ))/odd['OPEN' ].shift(-1 ) pred_rtn_na = odd['pred_rtn' ].isna() vol0 = odd['VOLUME' ].shift(-1 )==0 volna = odd['VOLUME' ].shift(-1 ).isna() odd['pred_rtn' ][vol0 | volna & (~pred_rtn_na)] = 0 yz = odd['HIGH' ].shift(-1 )==odd['LOW' ].shift(-1 ) zt = ~(odd['CLOSE' ].shift(-1 ) <= odd['CLOSE' ]) odd['pred_rtn' ][yz & zt & (~pred_rtn_na)] = 0 pred_rtn = odd['pred_rtn' ].stack().reset_index().rename(columns={0 : 'pred_rtn' , 'date' : 'open_date' }) all_data = pd.merge(all_data, pred_rtn, on=['open_date' , 'stock_code' ], how='left' ) all_data = all_data[~all_data['pred_rtn' ].isna()] del oddgc.collect()

1 2 3 4 5 6 7 8 9 10 11 close = pd.pivot(all_data, index='close_date' , columns='stock_code' , values='CLOSE' ) fac_ret = (close-close.shift(1 ))/close.shift(1 ) fac_ret = fac_ret.stack().reset_index().rename(columns={0 : 'fac_ret' , 'date' : 'close_date' }) all_data = pd.merge(all_data, fac_ret, on=['close_date' , 'stock_code' ], how='left' ) all_data['fac_size' ] = np.log(all_data['mkt_cap' ]/1000000 ) all_data['fac_bm' ] = all_data['EQY_BELONGTO_PARCOMSH' ] / all_data['mkt_cap' ]

1 2 3 factors = all_data[['stock_code' , 'close_date' , 'pred_rtn' , 'fac_ret' , 'fac_size' , 'fac_bm' ]].reset_index(drop=True ) factors = factors[~factors['pred_rtn' ].isna()] factors.head()

stock_code

close_date

pred_rtn

fac_ret

fac_size

fac_bm

0

000001.SZ

2006-01-06

-0.034375

NaN

9.431299

0.402075

1

000001.SZ

2006-01-13

0.008091

-0.031201

9.399601

0.415024

2

000001.SZ

2006-01-20

0.019262

0.003221

9.402816

0.413692

3

000001.SZ

2006-01-25

-0.022047

0.019262

9.421895

0.405874

4

000001.SZ

2006-02-10

0.004831

-0.022047

9.399601

0.415024

1 factors.to_csv("../cal_data/factors.csv" , index=False )

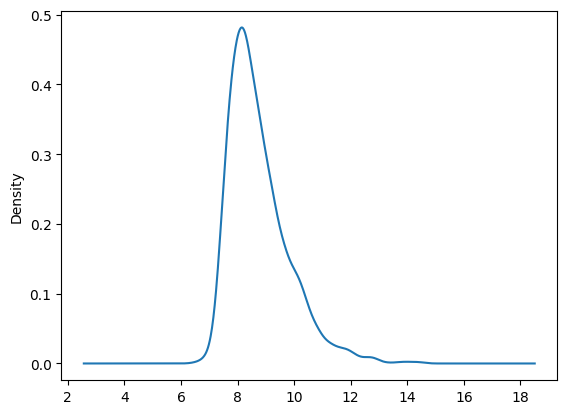

因子截尾处理 1 2 3 fac_name = 'fac_size' factors[factors['close_date' ]=='2019-10-18' ][fac_name].plot.kde(title="2019-10-18日 Size因子分布情况(截尾前)" )

1 2 3 factors = backtest.winsorize_factor(factors, 'fac_size' ) factors = backtest.winsorize_factor(factors, 'fac_ret' ) factors = backtest.winsorize_factor(factors, 'fac_bm' )

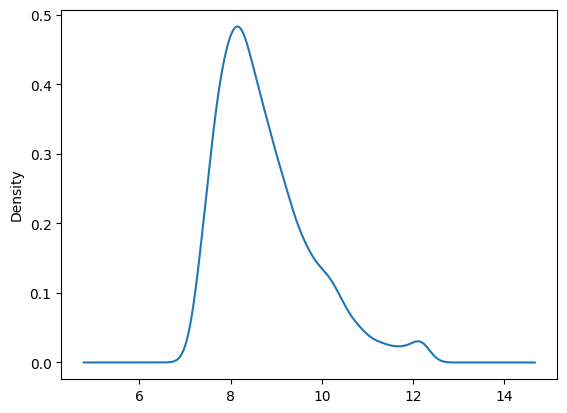

1 2 factors[factors['close_date' ]=='2019-10-18' ][fac_name].plot.kde(title="2019-10-18日 Size因子分布情况(截尾后)" )

对单个因子测试 通过Fama-MacBeth回归验证模型效果 1 2 3 4 5 res_list = [] for fac_name in ['fac_size' , 'fac_ret' , 'fac_bm' ]: res_list.append(backtest.fama_macbeth(factors, fac_name)) fama_macbeth_res = pd.DataFrame(res_list) fama_macbeth_res

fac_name

t

p

pos_count

neg_count

0

fac_size

-4.576268

5.395101e-06

362

541

1

fac_ret

-10.642792

5.330462e-25

290

612

2

fac_bm

4.019551

6.317205e-05

464

439

针对这一分析结果,三个因子t检验显著区别于0,是比较有效的因子;而其中账面市值比显著为正,其他两个显著为负数,也符合日常学术研究中对其的认知。

其中,账面市值比因子回归后斜率分别为正负的数量基本相同,区分效应较差,因此从这一维度来说,他的效果并不是很好。

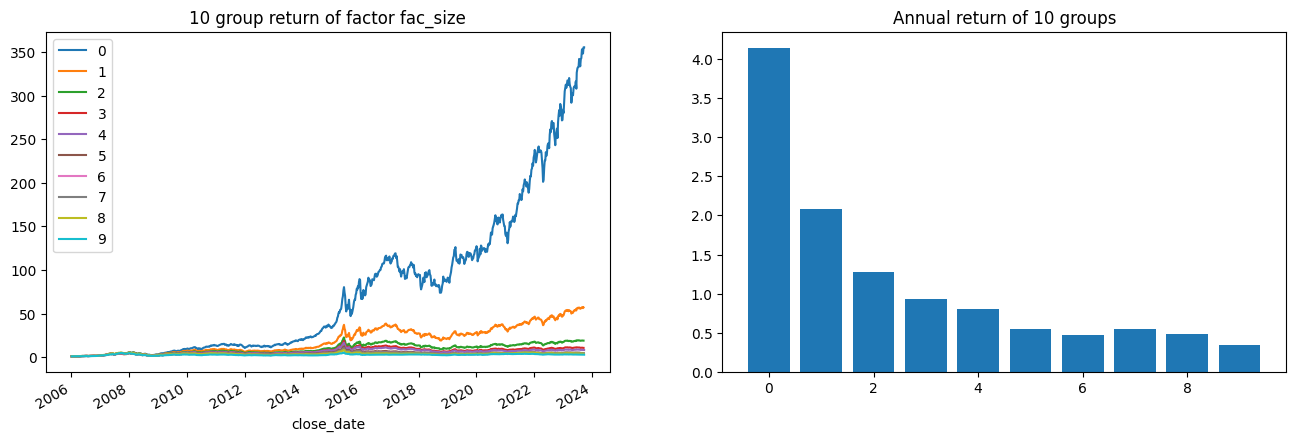

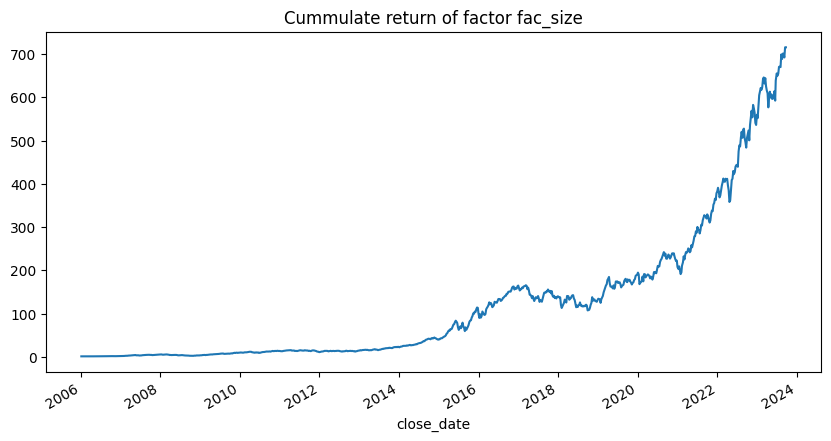

单因子分组收益情况 1 group_rtns, group_cum_rtns = backtest.group_return_analysis(factors, 'fac_size' )

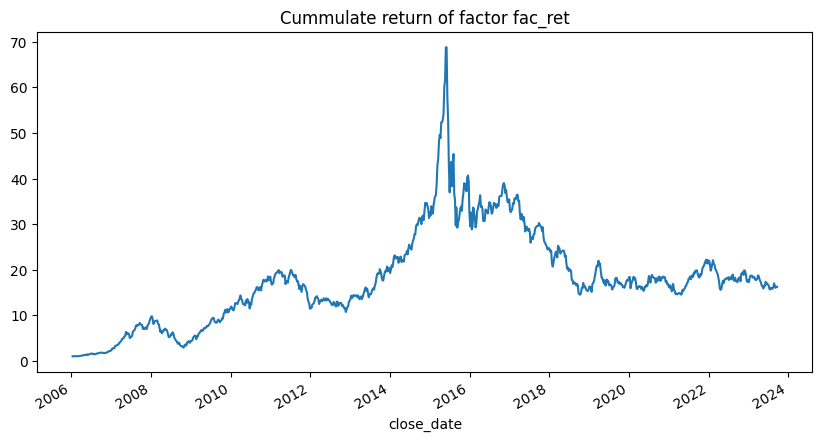

1 group_rtns, group_cum_rtns = backtest.group_return_analysis(factors, 'fac_ret' )

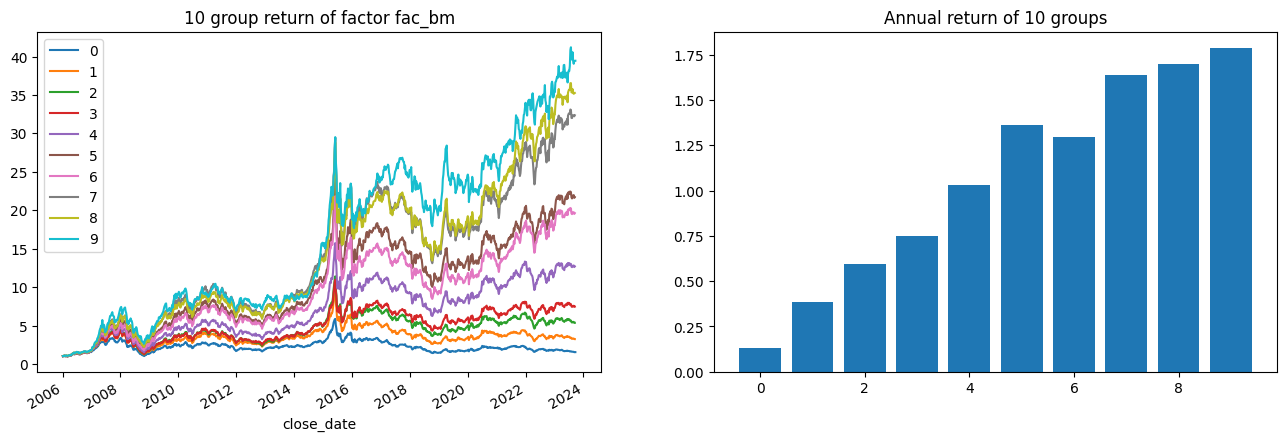

1 group_rtns, group_cum_rtns = backtest.group_return_analysis(factors, 'fac_bm' )

回测后看出,三个因子都有一定的分组效果,其中账面市值比与市值因子分组效果最好,收益率因子分组效果相对差一些。

单因子周度百股策略回测 1 2 rtn, evaluate_result = backtest.backtest_1week_nstock(factors, 'fac_ret' , True ) evaluate_result

sharpe_ratio

max_drawdown

max_drawdown_start

max_drawdown_end

sortino_ratio

annual_return

annual_volatility

section

0

1.405346

0.789046

2015-06-05

2018-10-12

2.030548

1.178091

0.763147

Sum

1

6.653799

0.108753

2006-06-30

2006-07-28

9.882821

67.674182

0.674358

2006

2

7.957098

0.217392

2007-05-18

2007-06-22

11.966749

1336.033077

0.975551

2007

3

-2.535012

0.699955

2008-01-11

2008-10-24

-4.945847

-0.975181

1.181429

2008

4

6.570332

0.143081

2009-02-06

2009-02-20

8.999942

121.088407

0.783940

2009

5

3.688373

0.198535

2010-04-02

2010-06-25

6.296923

9.382755

0.702845

2010

6

-3.329041

0.426803

2011-07-08

2011-12-30

-4.826786

-0.906297

0.645434

2011

7

1.483952

0.243869

2012-03-02

2012-11-23

2.545457

1.049363

0.604799

2012

8

4.117017

0.134629

2013-05-24

2013-06-21

7.282607

7.479792

0.558735

2013

9

4.479553

0.096290

2014-11-21

2014-12-26

9.303073

8.344907

0.531904

2014

10

0.683548

0.575212

2015-06-05

2015-09-11

0.882963

-0.014136

1.347235

2015

11

0.957265

0.155600

2016-04-08

2016-05-06

1.431324

0.558164

0.753643

2016

12

-3.226729

0.330036

2017-03-17

2017-12-22

-4.293738

-0.829643

0.506809

2017

13

-2.996387

0.425417

2018-03-23

2018-10-12

-4.204086

-0.896640

0.677827

2018

14

1.305734

0.287685

2019-03-29

2019-08-02

2.413080

0.887732

0.639300

2019

15

-0.294687

0.168351

2020-02-14

2020-05-15

-0.414377

-0.325593

0.640734

2020

16

2.825869

0.139483

2021-02-10

2021-04-23

5.050823

2.591822

0.496437

2021

17

-1.196824

0.294684

2022-02-11

2022-04-22

-2.205050

-0.610259

0.625781

2022

18

-1.182782

0.165736

2023-03-31

2023-07-21

-2.770508

-0.440561

0.418921

2023

6

-3.329041

0.426803

2011-07-08

2011-12-30

-4.826786

-0.906297

0.645434

2011

7

1.483952

0.243869

2012-03-02

2012-11-23

2.545457

1.049363

0.604799

2012

8

4.117017

0.134629

2013-05-24

2013-06-21

7.282607

7.479792

0.558735

2013

9

4.479553

0.096290

2014-11-21

2014-12-26

9.303073

8.344907

0.531904

2014

10

0.683548

0.575212

2015-06-05

2015-09-11

0.882963

-0.014136

1.347235

2015

11

0.957265

0.155600

2016-04-08

2016-05-06

1.431324

0.558164

0.753643

2016

12

-3.226729

0.330036

2017-03-17

2017-12-22

-4.293738

-0.829643

0.506809

2017

13

-2.996387

0.425417

2018-03-23

2018-10-12

-4.204086

-0.896640

0.677827

2018

14

1.305734

0.287685

2019-03-29

2019-08-02

2.413080

0.887732

0.639300

2019

15

-0.294687

0.168351

2020-02-14

2020-05-15

-0.414377

-0.325593

0.640734

2020

16

2.825869

0.139483

2021-02-10

2021-04-23

5.050823

2.591822

0.496437

2021

17

-1.196824

0.294684

2022-02-11

2022-04-22

-2.205050

-0.610259

0.625781

2022

18

-1.182782

0.165736

2023-03-31

2023-07-21

-2.770508

-0.440561

0.418921

2023

1 2 rtn, evaluate_result = backtest.backtest_1week_nstock(factors, 'fac_size' , True ) evaluate_result

sharpe_ratio

max_drawdown

max_drawdown_start

max_drawdown_end

sortino_ratio

annual_return

annual_volatility

section

0

3.122859

0.610775

2008-01-11

2008-10-24

4.453695

5.248983

0.658517

Sum

1

3.780915

0.082394

2006-09-29

2006-11-10

6.824324

7.448274

0.615477

2006

2

7.619150

0.277240

2007-05-18

2007-06-22

7.588304

550.342103

0.891182

2007

3

-1.678621

0.610775

2008-01-11

2008-10-24

-2.910806

-0.884322

0.992800

2008

4

7.547957

0.115055

2009-02-06

2009-02-20

10.933357

167.053901

0.719293

2009

5

3.022128

0.245051

2010-04-02

2010-06-25

4.223931

4.525651

0.633368

2010

6

-1.694132

0.302932

2011-04-15

2011-12-30

-2.558479

-0.681412

0.576306

2011

7

2.662808

0.146320

2012-03-02

2012-11-23

4.112191

3.122259

0.600360

2012

8

5.374411

0.131401

2013-05-24

2013-06-21

8.249390

9.844832

0.465409

2013

9

7.121590

0.112333

2014-11-21

2014-12-26

13.799625

13.415354

0.386941

2014

10

5.110443

0.288560

2015-06-05

2015-08-28

6.782858

81.649740

0.961526

2015

11

4.188296

0.088634

2016-04-08

2016-05-06

5.508037

11.105522

0.647160

2016

12

-1.330087

0.232662

2017-03-10

2017-07-14

-2.252187

-0.552614

0.507959

2017

13

-0.081387

0.247255

2018-05-18

2018-09-28

-0.119885

-0.276922

0.731677

2018

14

3.747108

0.148059

2019-04-12

2019-05-31

5.904712

5.290640

0.529220

2019

15

1.042077

0.141963

2020-08-28

2020-12-31

1.448336

0.533958

0.560545

2020

16

6.727338

0.085806

2021-01-15

2021-01-29

16.085113

18.249285

0.457282

2021

17

3.816535

0.131406

2022-02-25

2022-04-22

8.065974

5.825747

0.542672

2022

18

4.185553

0.107099

2023-03-03

2023-04-14

8.362568

4.334733

0.421798

2023

1 2 rtn, evaluate_result = backtest.backtest_1week_nstock(factors, 'fac_bm' ) evaluate_result

sharpe_ratio

max_drawdown

max_drawdown_start

max_drawdown_end

sortino_ratio

annual_return

annual_volatility

section

0

2.006960

0.638422

2008-01-11

2008-10-24

2.918252

1.847405

0.617145

Sum

1

5.618410

0.105872

2006-06-30

2006-08-11

9.420005

21.852138

0.590378

2006

2

7.354710

0.281662

2007-05-18

2007-06-22

8.206541

980.089048

1.019448

2007

3

-2.479428

0.638422

2008-01-11

2008-10-24

-4.484640

-0.960315

1.067600

2008

4

6.410670

0.142736

2009-02-06

2009-02-20

10.016987

131.546624

0.820762

2009

5

0.156546

0.274959

2010-04-02

2010-06-25

0.242633

-0.062901

0.555388

2010

6

-2.983162

0.329127

2011-04-15

2011-12-30

-5.263885

-0.730526

0.410657

2011

7

2.215259

0.162853

2012-02-24

2012-09-14

4.250416

1.304317

0.415575

2012

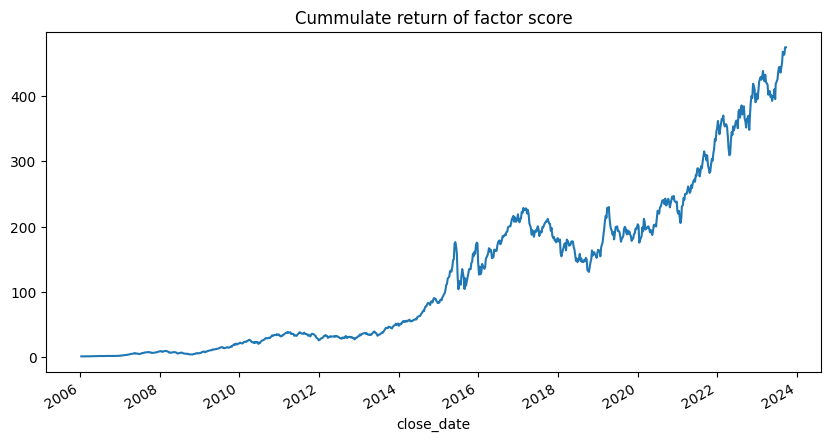

多因子组合 简单分组打分法 1 2 rtn, evaluate_result = backtest.mutifactor_score(factors, ['-fac_ret' , '-fac_size' , 'fac_bm' ], group_num=10 ) evaluate_result

sharpe_ratio

max_drawdown

max_drawdown_start

max_drawdown_end

sortino_ratio

annual_return

annual_volatility

section

0

2.762777

0.606990

2008-02-29

2008-10-24

3.828052

4.585105

0.718640

Sum

1

5.532422

0.102080

2006-06-30

2006-08-11

10.268628

26.228477

0.636676

2006

2

8.101543

0.287660

2007-05-18

2007-06-22

8.857011

2223.268814

1.031276

2007

3

-0.937202

0.606990

2008-02-29

2008-10-24

-1.643112

-0.829617

1.169914

2008

4

7.927451

0.138606

2009-02-06

2009-02-20

11.627565

466.483920

0.826747

2009

5

4.065468

0.241853

2010-04-02

2010-06-25

5.996514

11.165462

0.672587

2010

6

-2.182011

0.333801

2011-03-18

2011-12-30

-3.358018

-0.776748

0.602593

2011

7

2.119900

0.196653

2012-03-02

2012-11-23

3.458198

1.997337

0.603504

2012

8

4.936706

0.168503

2013-05-24

2013-06-21

7.691246

9.718052

0.508523

2013

9

5.649539

0.083951

2014-11-21

2014-12-26

11.179287

9.436769

0.433277

2014

10

2.837548

0.410130

2015-06-05

2015-07-03

3.294351

12.990229

1.190048

2015

11

3.568117

0.091504

2016-04-08

2016-05-06

4.329537

7.026963

0.643478

2016

12

-1.778931

0.230229

2017-02-17

2017-12-15

-2.780930

-0.592425

0.447876

2017

13

-0.659488

0.275744

2018-01-19

2018-10-12

-0.949217

-0.497481

0.686670

2018

14

2.215944

0.231712

2019-04-12

2019-08-02

4.274694

2.091116

0.585855

2019

15

1.242012

0.138234

2020-01-03

2020-01-17

1.719817

0.735576

0.577622

2020

16

5.216823

0.104639

2021-09-03

2021-10-22

10.806690

7.976897

0.440638

2021

17

1.588294

0.164306

2022-02-25

2022-04-22

3.120165

1.013708

0.526335

2022

18

3.335436

0.104342

2023-02-24

2023-05-19

6.708995

2.018183

0.349659

2023

相比于单个”市值“因子,因子组合后效果变差了。

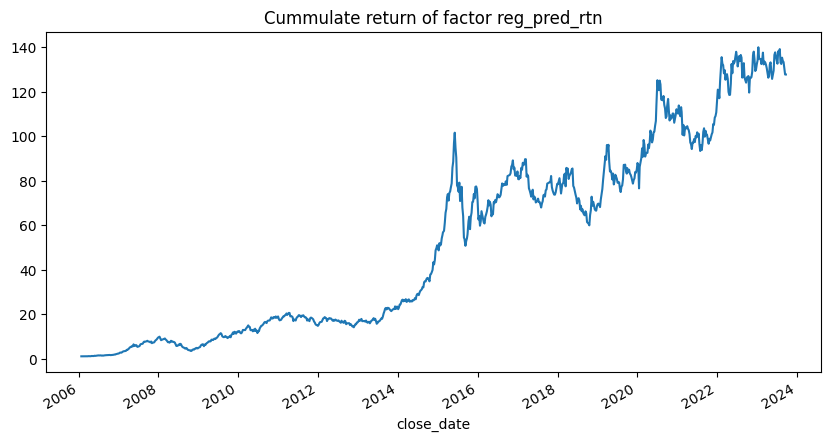

多元回归选股法 1 rtn, evaluate_result = backtest.mutifactor_regression(factors, ['fac_ret' , 'fac_size' , 'fac_bm' ], stock_num=100 , plot=True )

sharpe_ratio

max_drawdown

max_drawdown_start

max_drawdown_end

sortino_ratio

annual_return

annual_volatility

section

0

2.381925

0.653284

2008-01-11

2008-10-24

3.633037

2.883003

0.663260

Sum

1

7.397497

0.083543

2006-07-21

2006-08-11

14.551758

80.247146

0.625025

2006

2

8.605610

0.176219

2007-05-18

2007-06-22

12.445344

1427.010829

0.901967

2007

3

-2.899683

0.653284

2008-01-11

2008-10-24

-5.515209

-0.960043

0.949763

2008

4

5.760640

0.194681

2009-07-24

2009-09-25

10.102339

88.968733

0.848765

2009

5

3.671218

0.230784

2010-04-02

2010-06-25

5.466090

8.329292

0.671275

2010

6

-2.037976

0.284170

2011-04-08

2011-12-30

-3.026109

-0.713988

0.541419

2011

7

1.235993

0.245804

2012-03-02

2012-11-23

2.141001

0.664276

0.520239

2012

8

3.641103

0.138178

2013-05-24

2013-06-21

6.342497

4.966395

0.530263

2013

9

7.529679

0.045554

2014-03-14

2014-03-21

17.314748

37.479723

0.504501

2014

10

2.234365

0.500596

2015-06-05

2015-09-11

3.162736

4.403217

0.969233

2015

11

1.734332

0.101322

2016-04-08

2016-05-06

2.097476

1.306984

0.579563

2016

12

-0.528623

0.242558

2017-03-10

2017-08-04

-0.667913

-0.286437

0.448402

2017

13

-0.812079

0.301313

2018-03-23

2018-10-19

-1.385928

-0.489442

0.606122

2018

14

2.260950

0.221067

2019-04-12

2019-08-02

4.214248

1.881747

0.529546

2019

15

2.290055

0.152632

2020-07-03

2020-12-04

3.748461

2.656131

0.660382

2020

16

0.660965

0.179802

2021-01-15

2021-07-30

0.985279

0.216939

0.447280

2021

17

1.549873

0.132950

2022-06-24

2022-10-21

2.930357

0.977742

0.528017

2022

18

-0.475897

0.101506

2023-01-13

2023-05-19

-0.929460

-0.216187

0.371352

2023

对比前面的诸多策略,该策略的收益率并不算高(尤其和市值因子相比),这也是因为我们回归后的系数滞后了两周才进行预测的结果。

但是,整体来看该策略的效果是比Ret,B/M因子的效果好的,而且相比于Size因子,该策略可以很好的消除市场风格的影响。

在2017年的大盘股行情中,该策略的最大回撤只有25%,比单纯的Size因子好很多。